Should you wait to buy a house? This question is the number one topic Homespace clients have asked about this month. Rising interest rates and potential market volatility understandably have many would-be buyers cautious. Let’s break down what’s happening in the market so you can decide whether you should wait to buy a house or act now.

In January of 2022, mortgage interest rates were around 3.5%. Now in May, they’re around 5.3%. Understandably, this increase has many buyers concerned. Higher rates affect how much house a buyer can afford, and in Austin’s market that can be a heavy conversation.

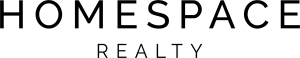

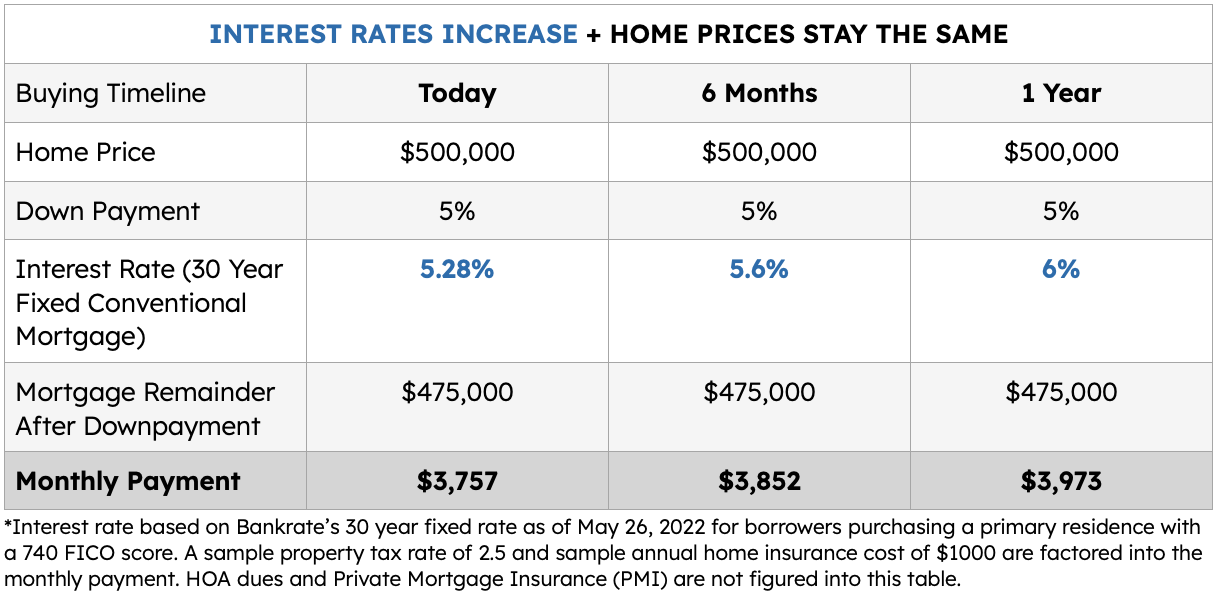

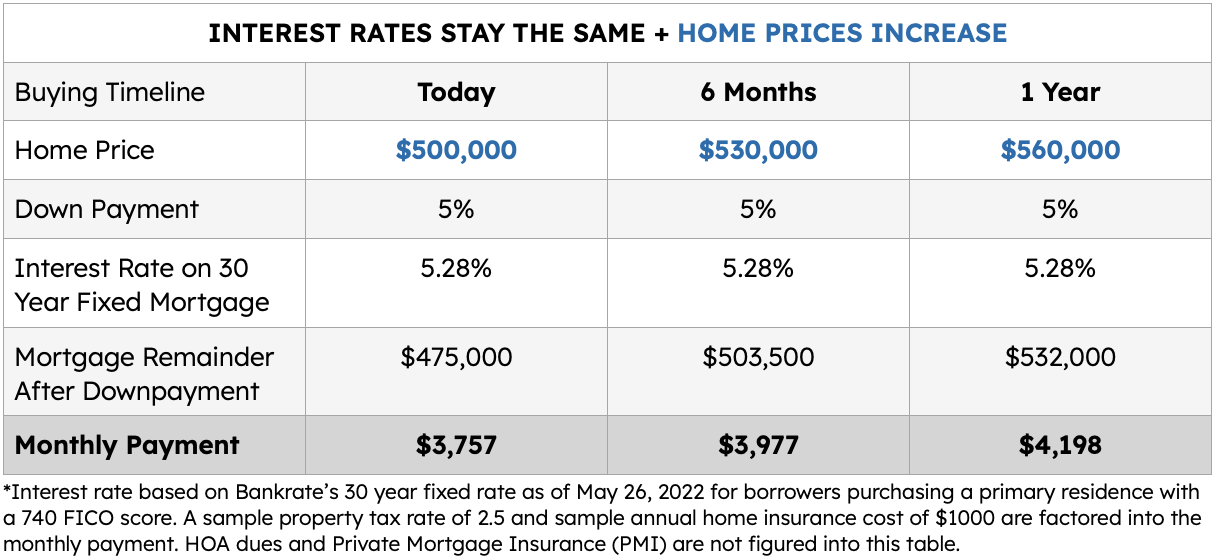

One of the top questions being asked is how rising interest rates will affect home prices in Austin, and if current buyers should wait to buy. Take a look at the tables below to see what a few different scenarios would look like.

As you can see, in every scenario above, waiting costs buyers more in the long run. Austin’s real estate market is uniquely poised to remain strong regardless of what happens elsewhere, for a number of reasons.

- Austin ranks 1st among 400 metro areas for housing growth and stability

- Austin ranks 1st for commercial real estate investments

- Austin ranks 2nd among the top 50 job markets in the US

- Austin ranks 4th in population growth and 2nd for fastest-growing cities in Texas

- Austin ranks 4th for best place to start a career

The Takeaway

The Austin Board of Realtors reported that home prices in Austin rose 30.8% in 2021. Current projections for 2022 hover between 10 and 15%. If you’ve been thinking about buying a house, now is the time to get in touch so we can discuss your options.

Unless both interest rates and home prices go down (neither of which is predicted to happen in Austin by any major housing authority), waiting to purchase a home will cost buyers more down the road.

We’d love to be your resource for all things real estate, so please reach out any time!